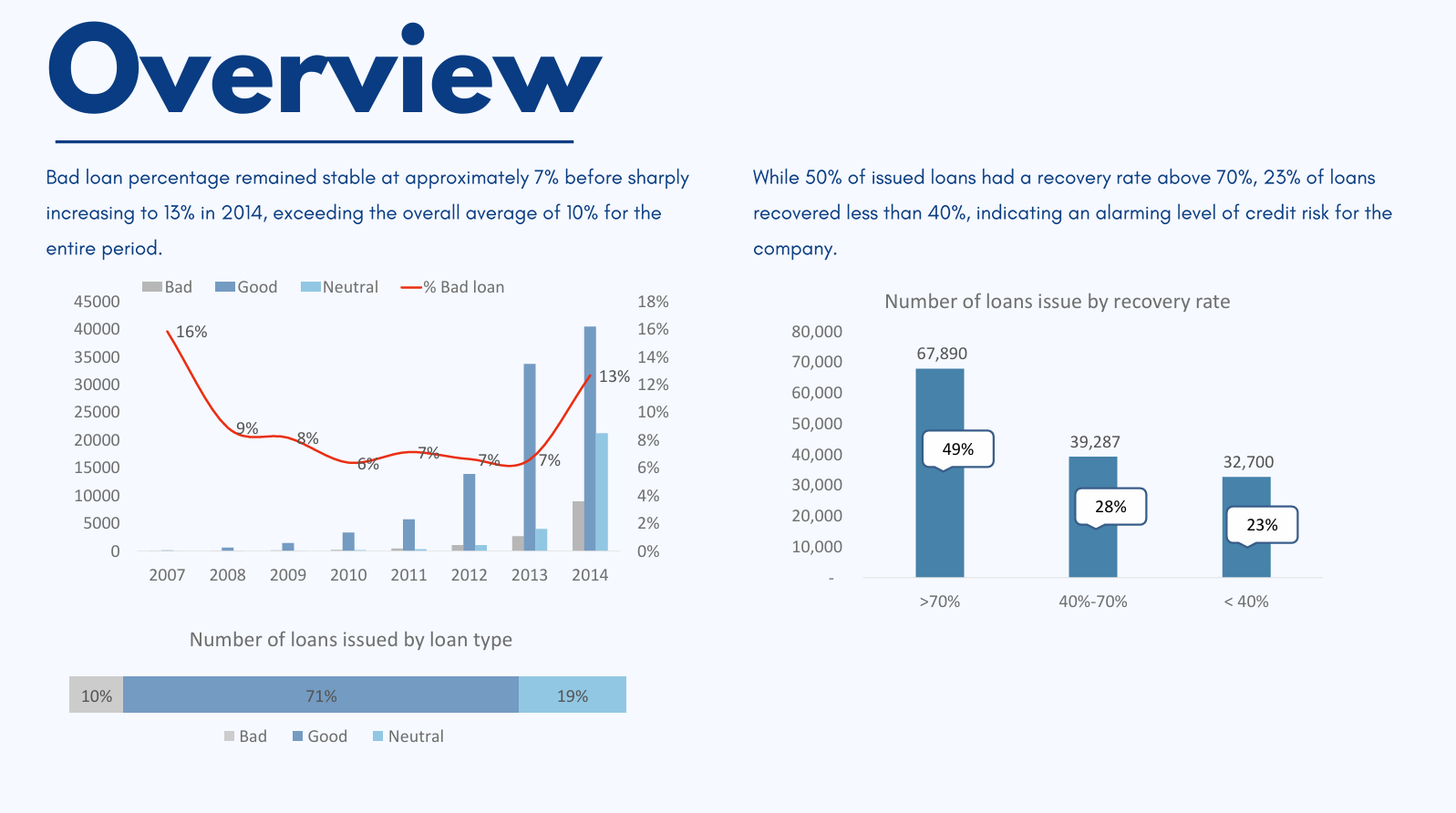

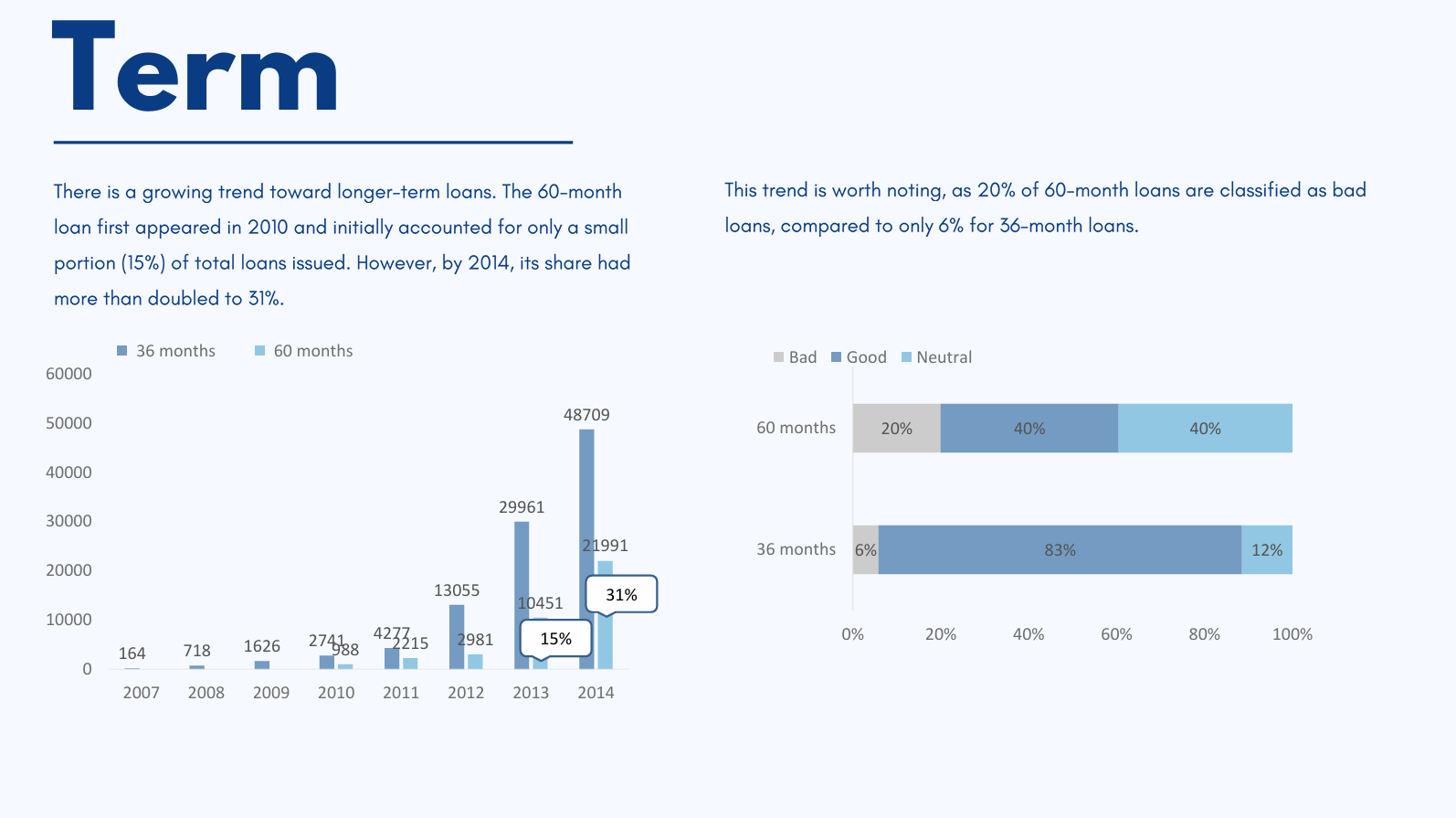

Project 1: Credit Risk Analysis

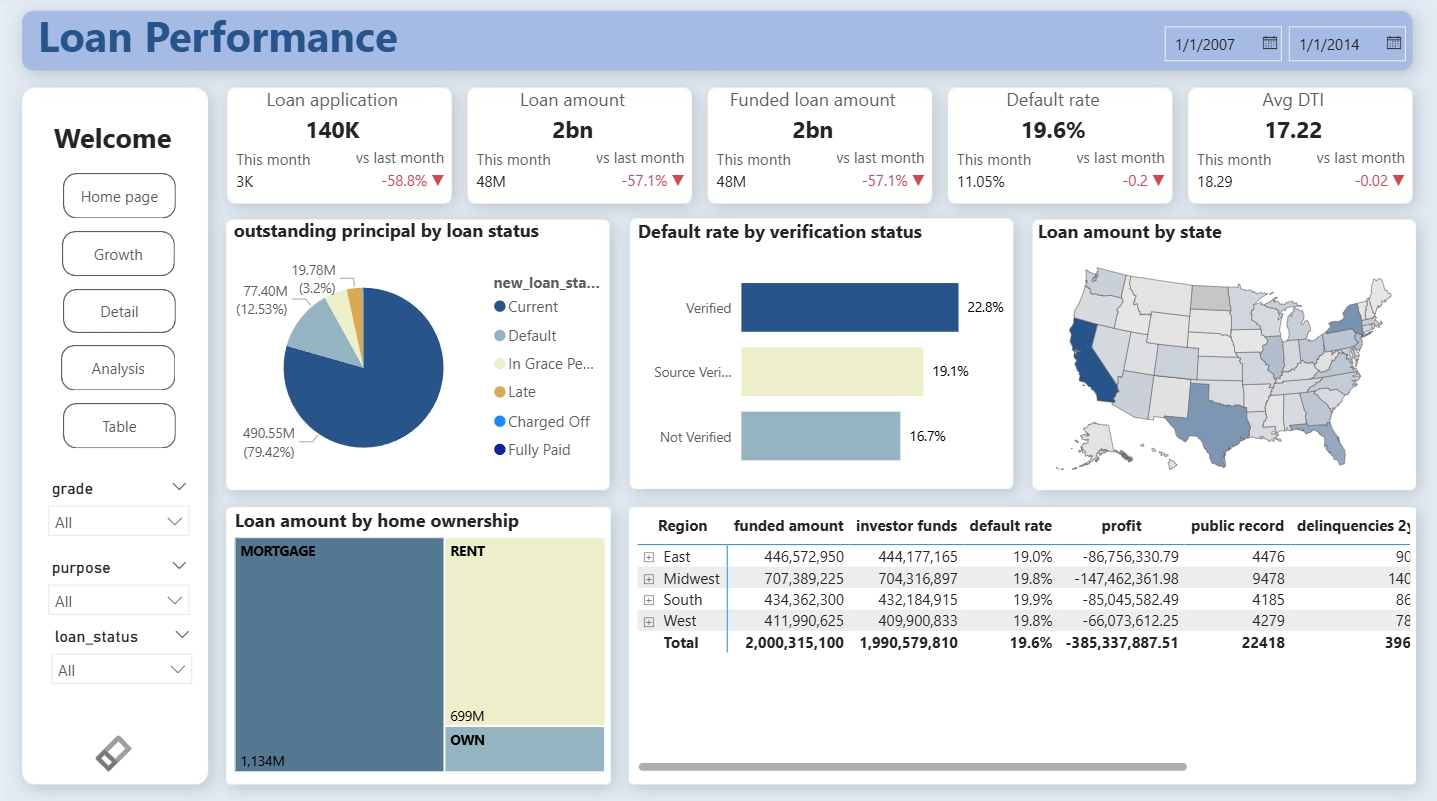

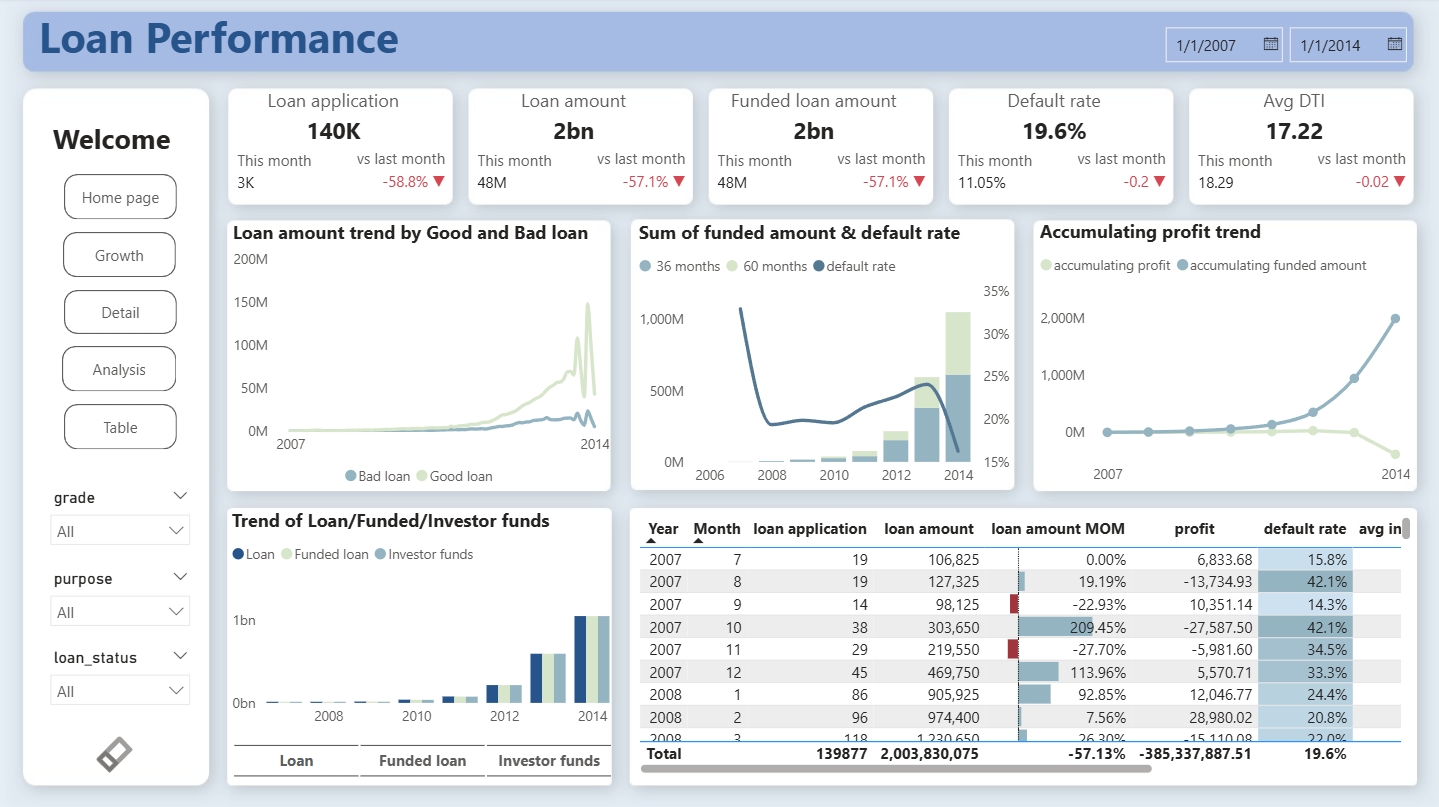

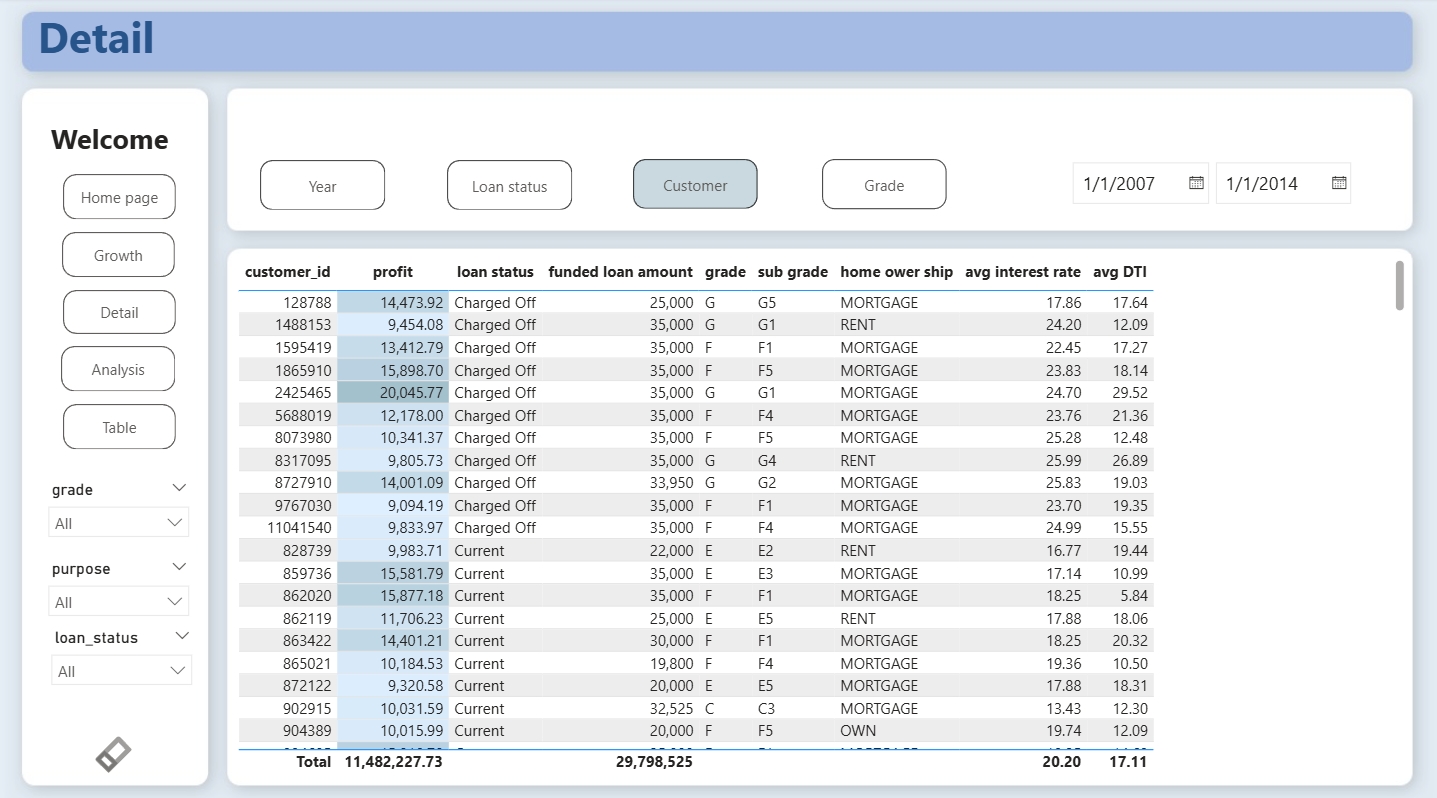

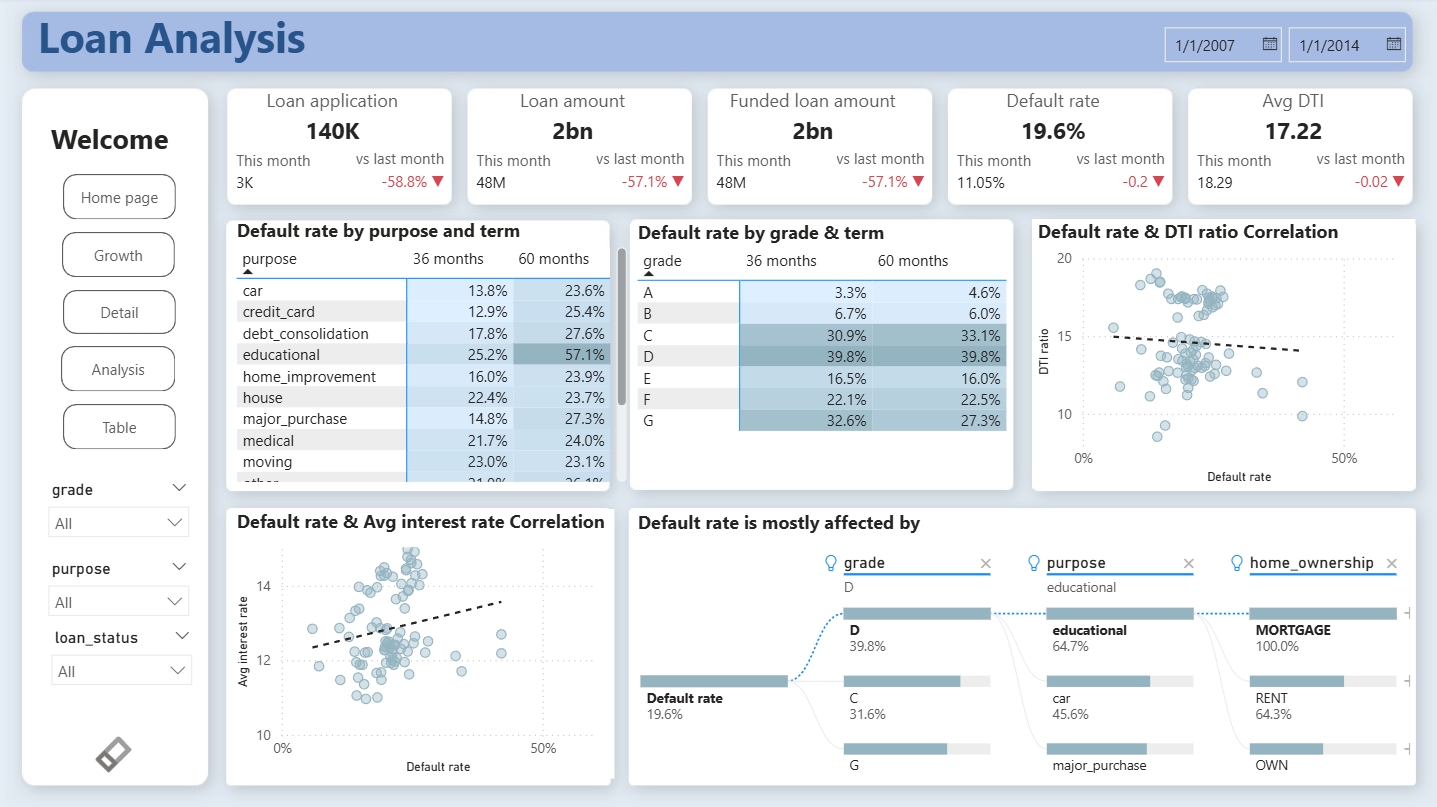

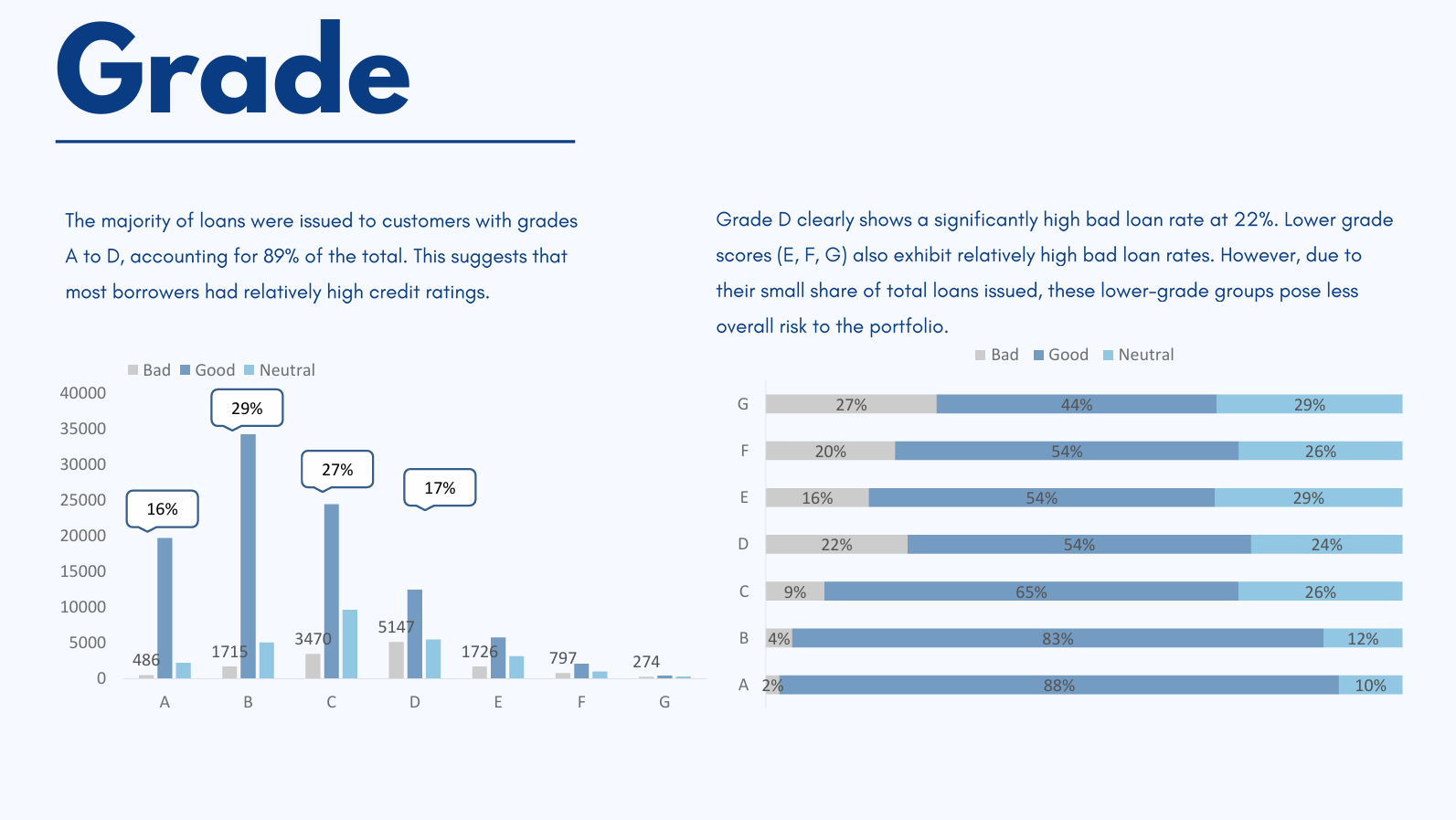

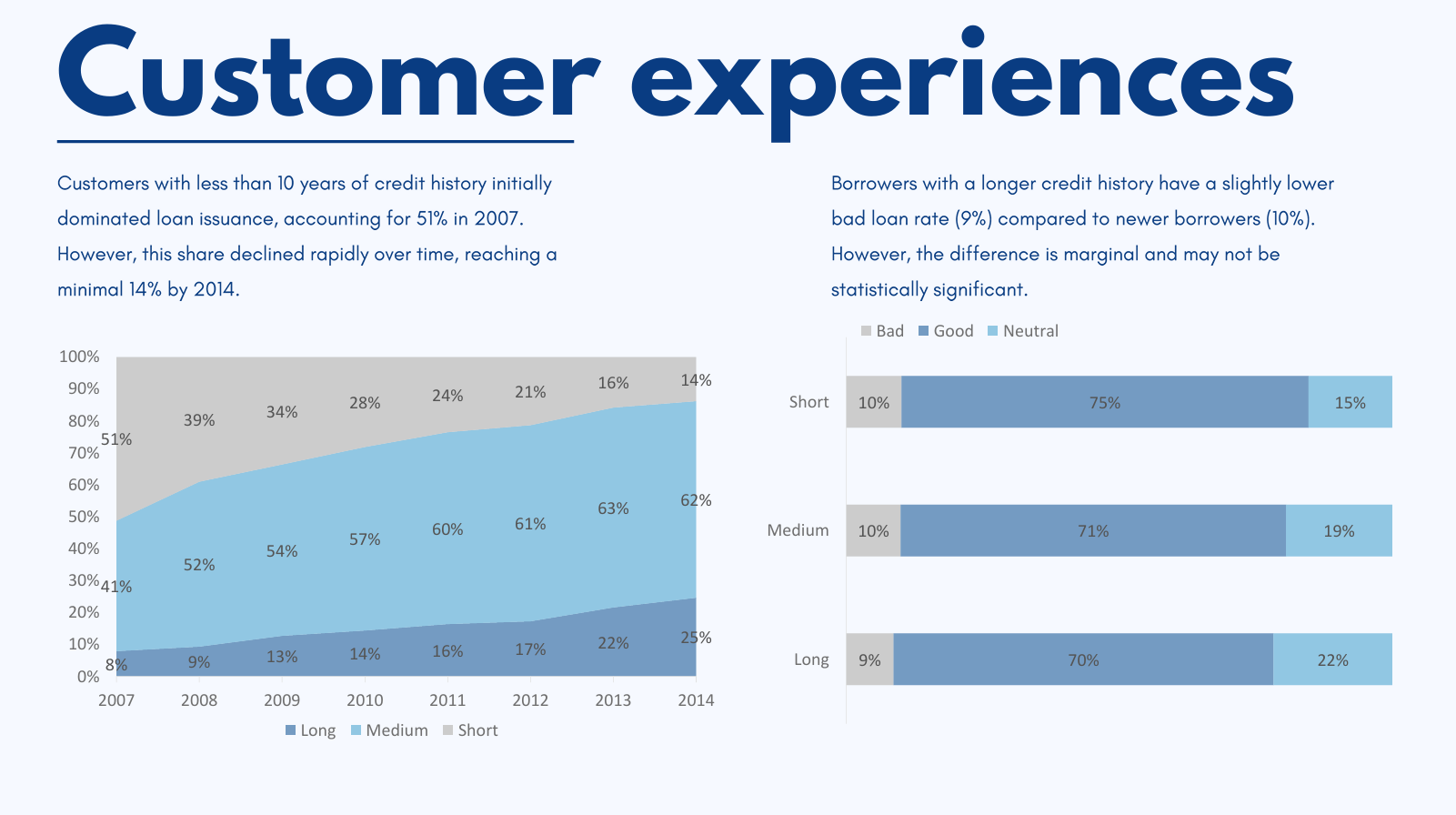

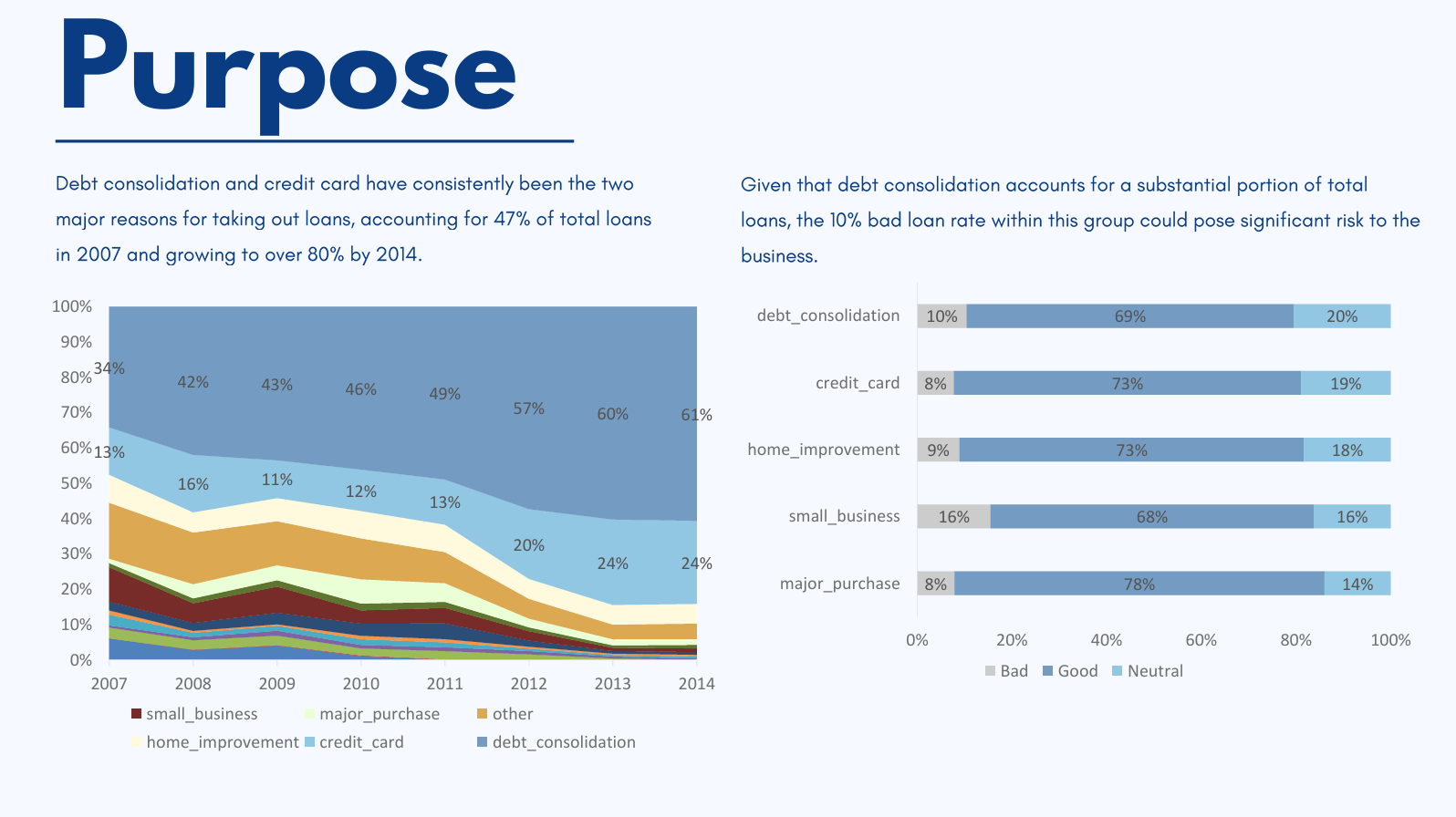

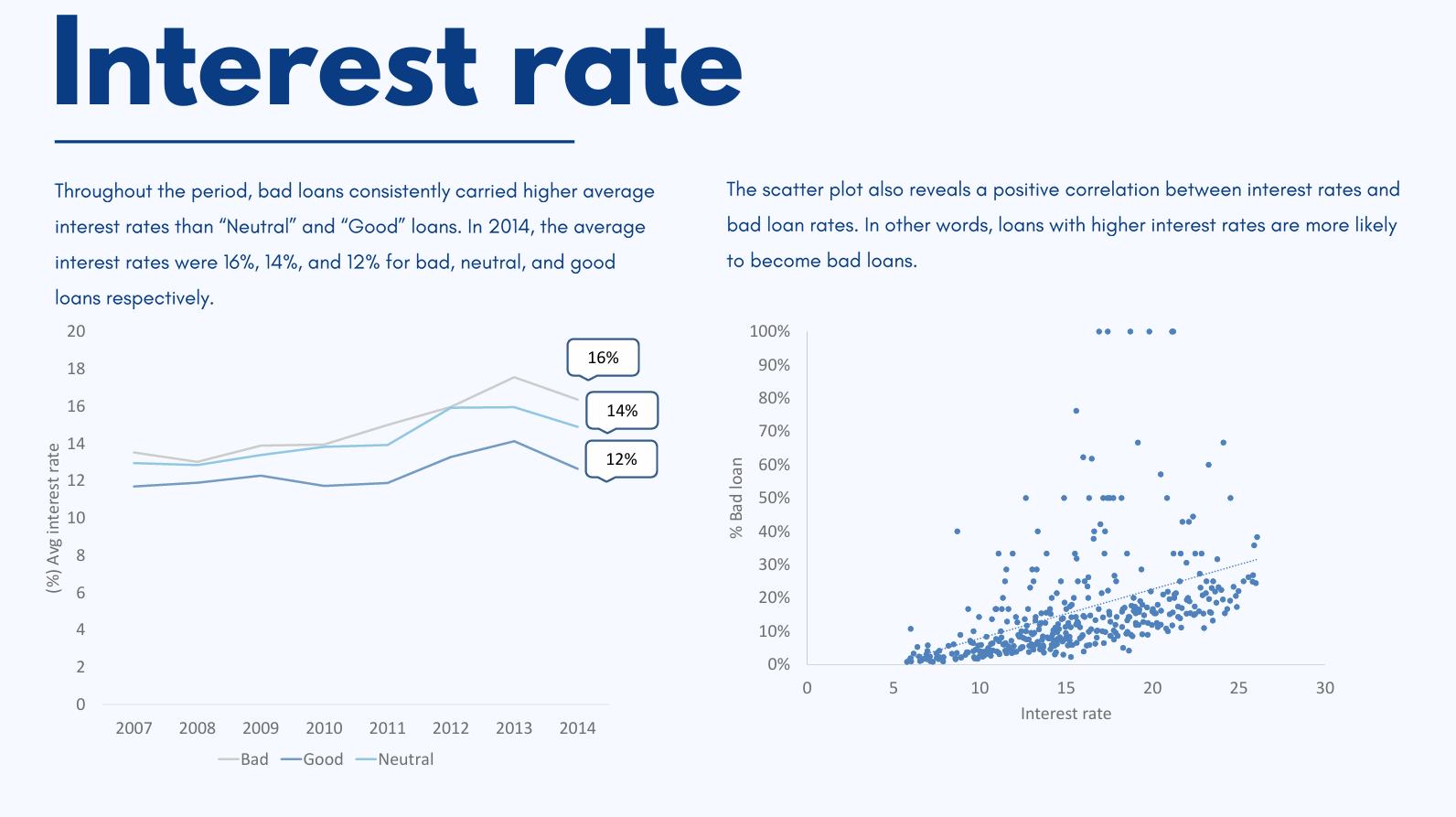

The project focused on analyzing credit risk in a peer-to-peer lending platform using historical loan data from 2007 to 2014. In response to the post-crisis surge in loan applications, using Power BI explores loan records and identifies behavioral patterns that distinguish good loans from bad ones based on credit profile, debt management pattern, financial capability and loan structure. The goal was to provide data-driven insights and recommendations to help reduce default risk and improve lending strategies through better borrower segmentation and risk monitoring.

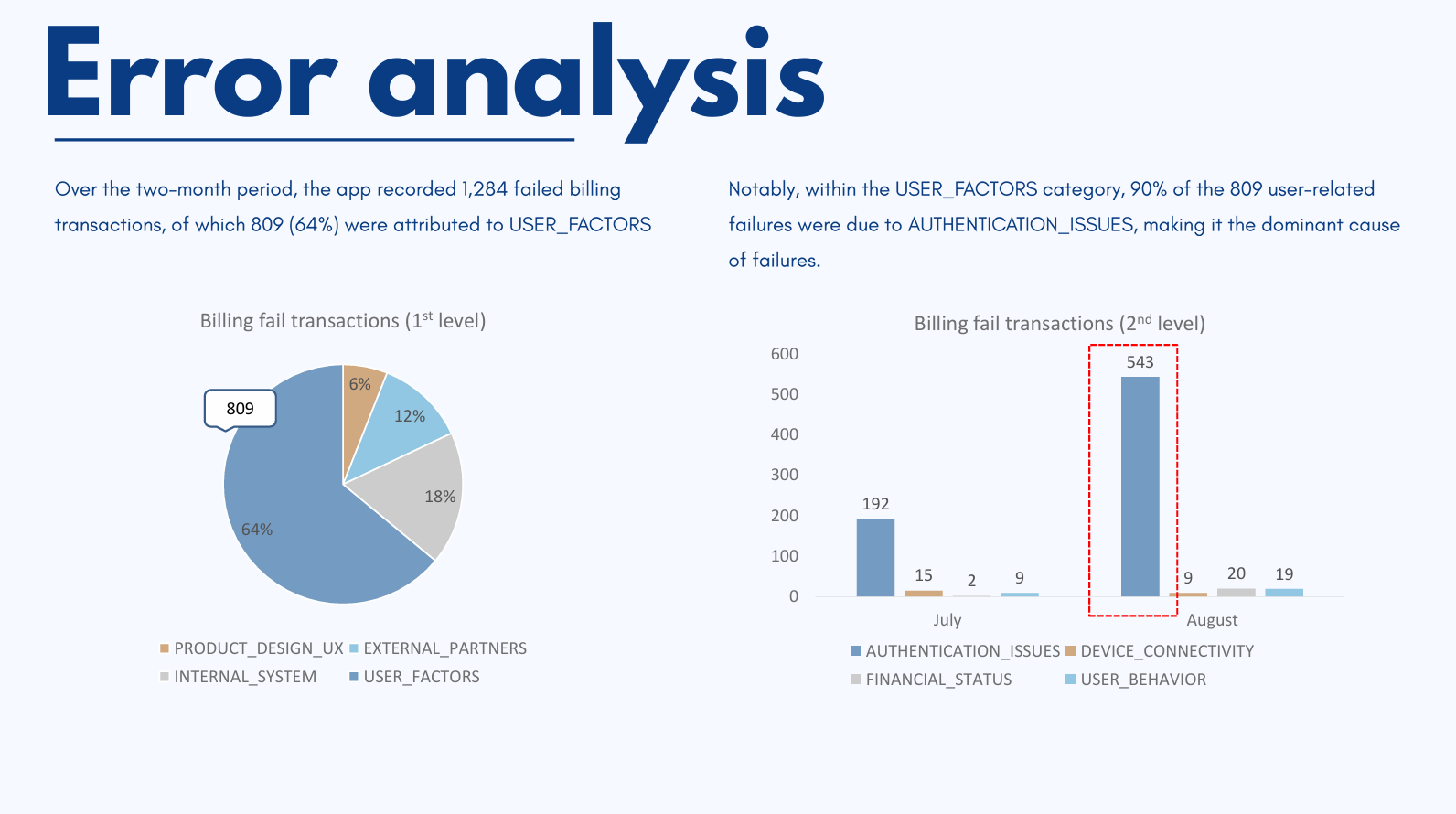

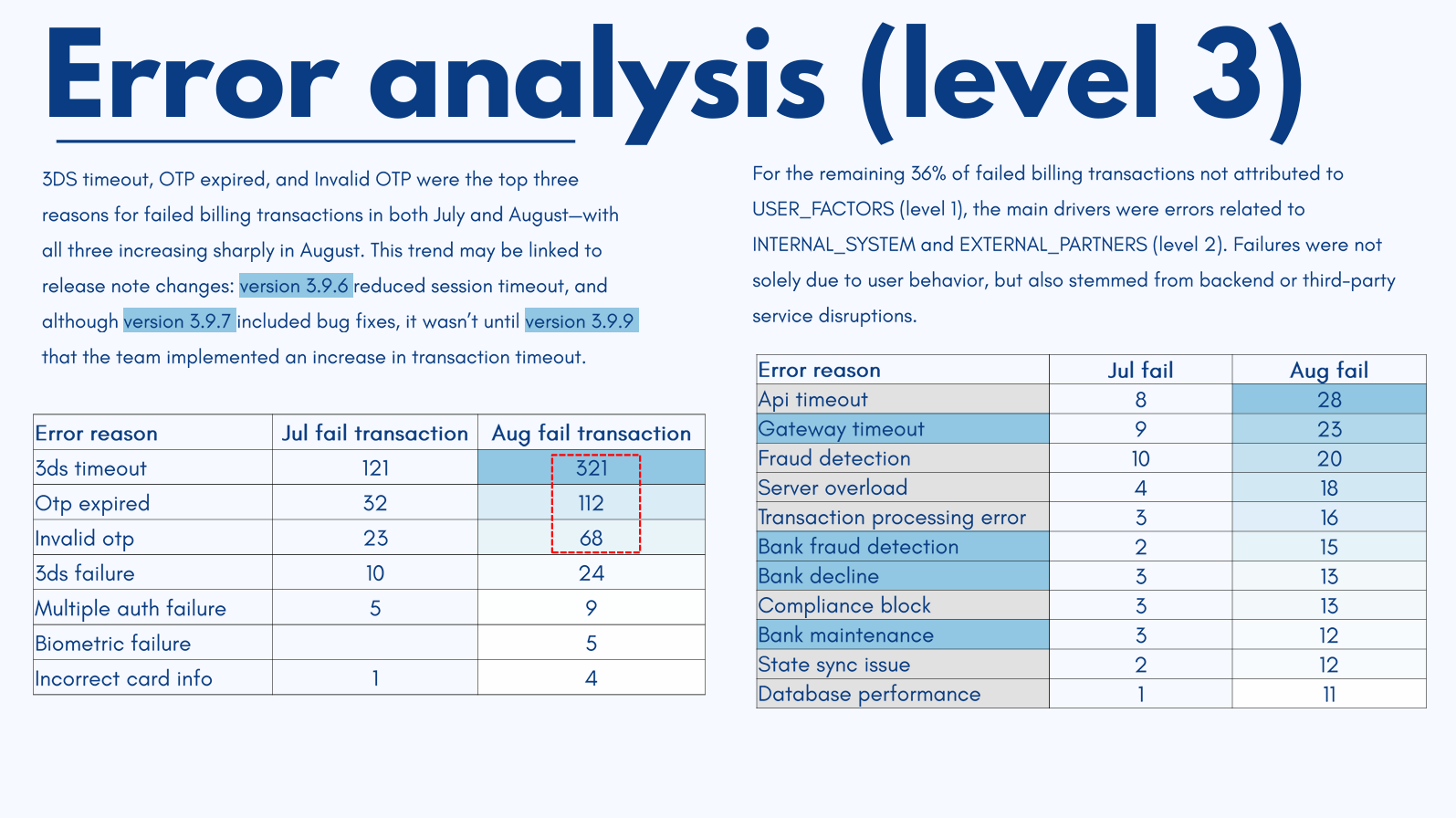

Project 2: App Optimization Analysis

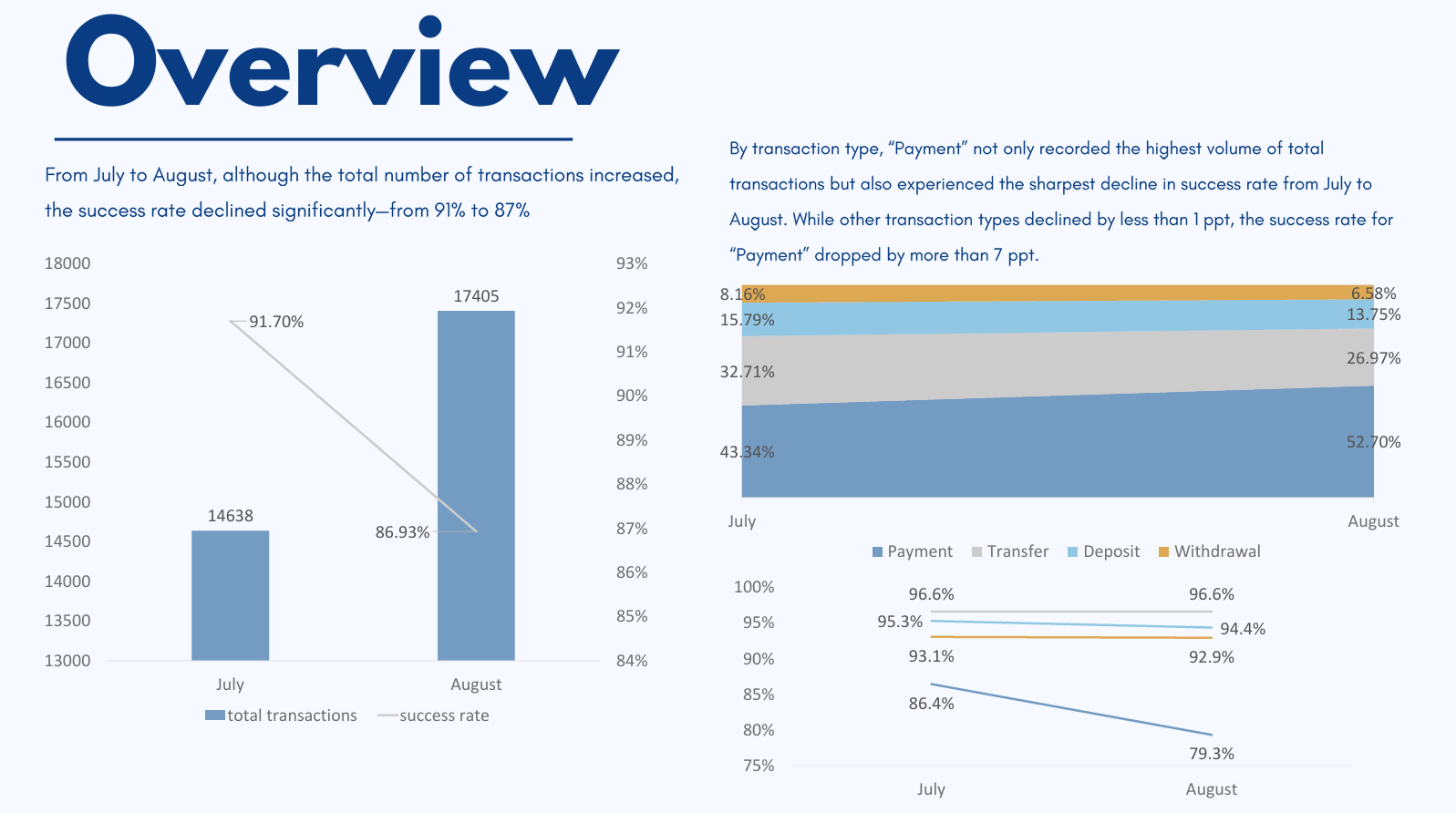

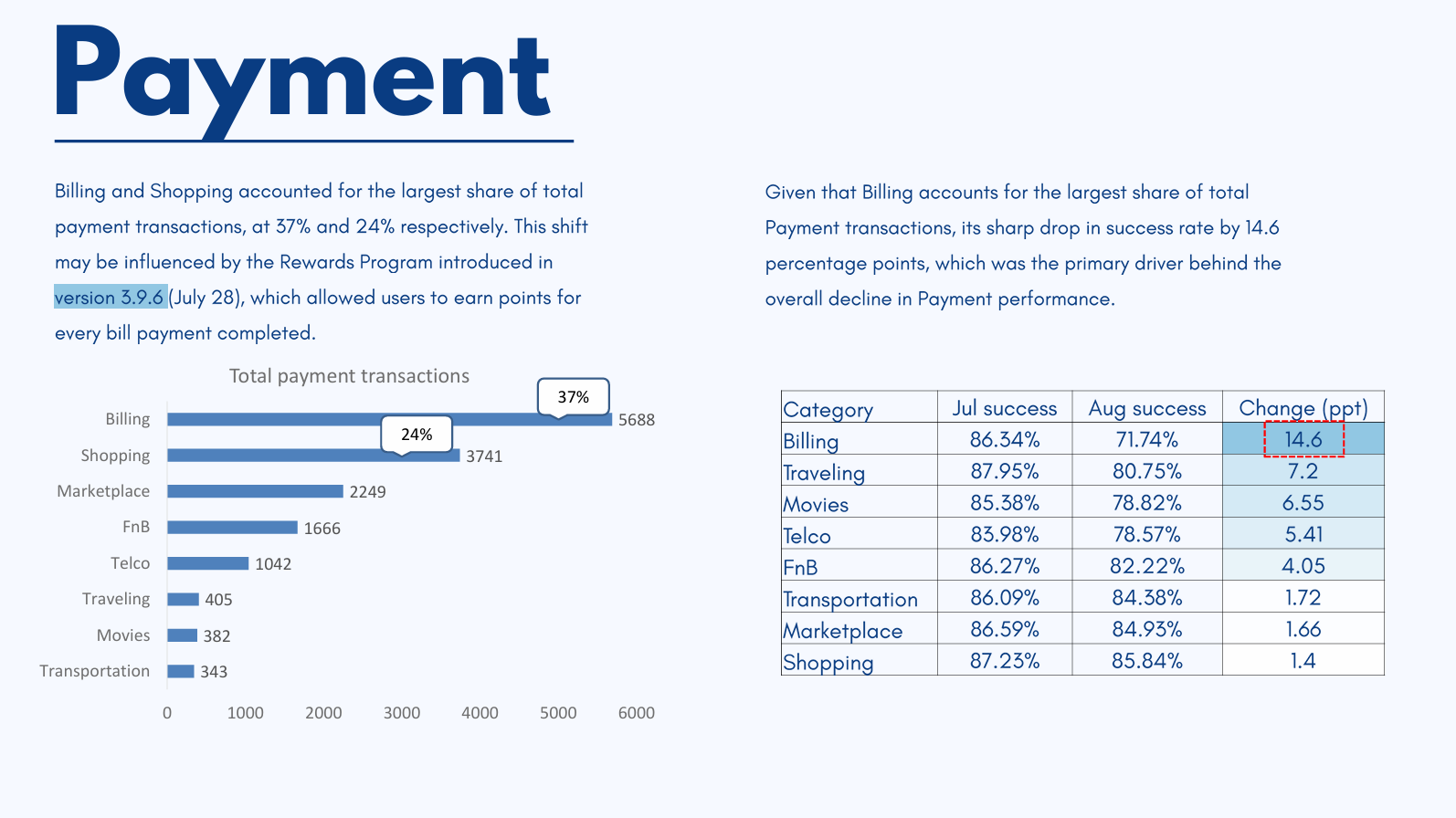

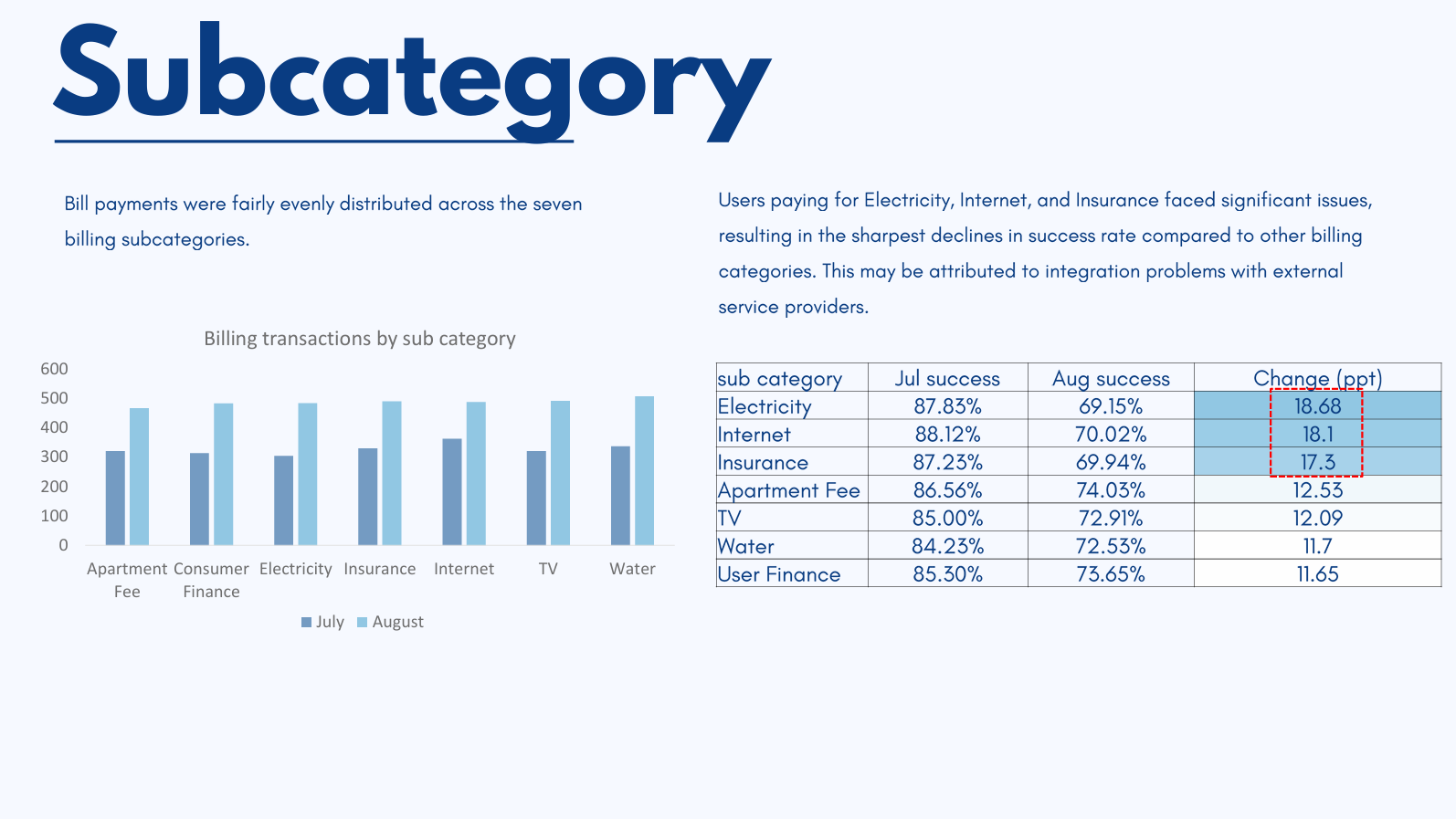

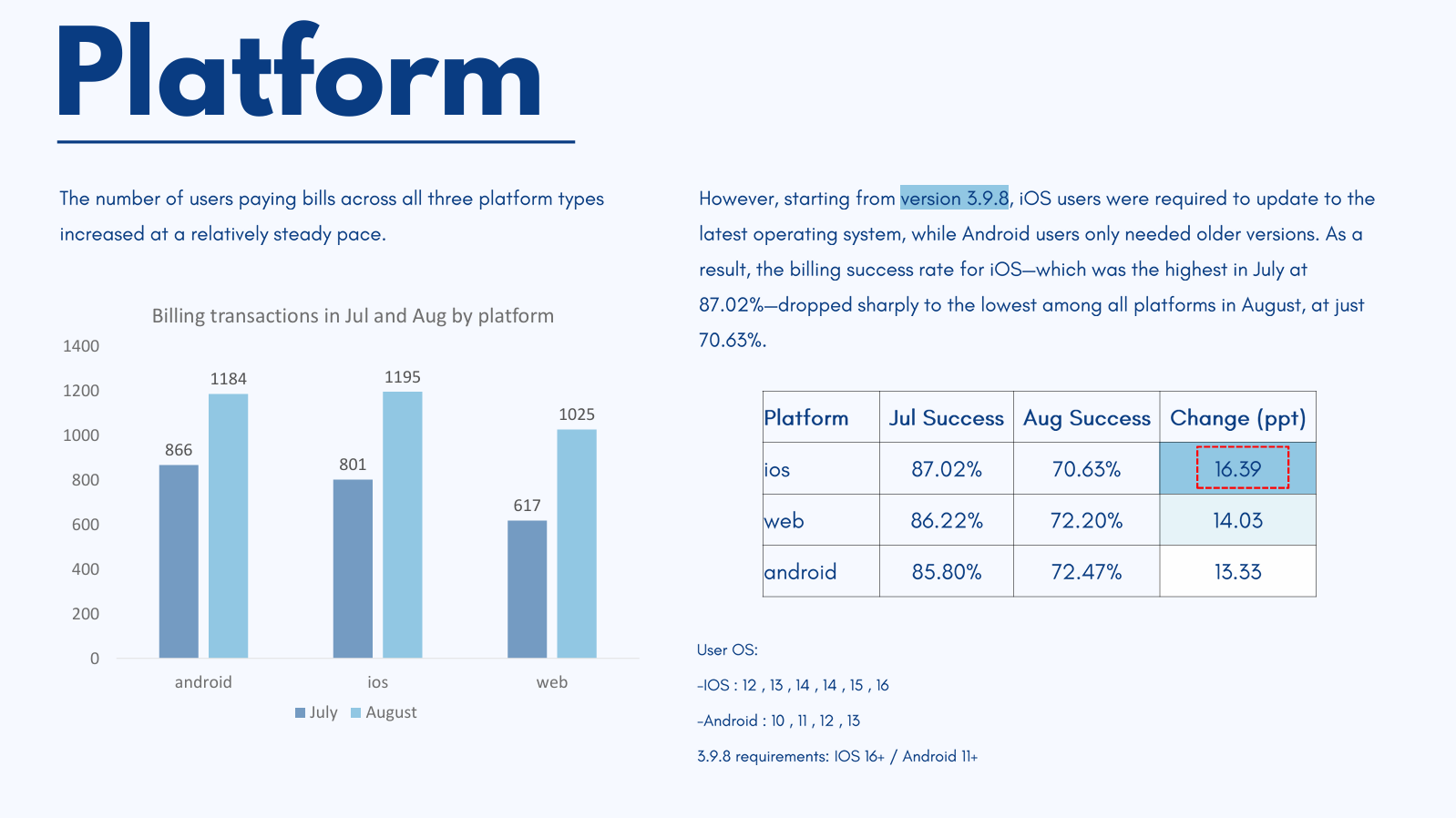

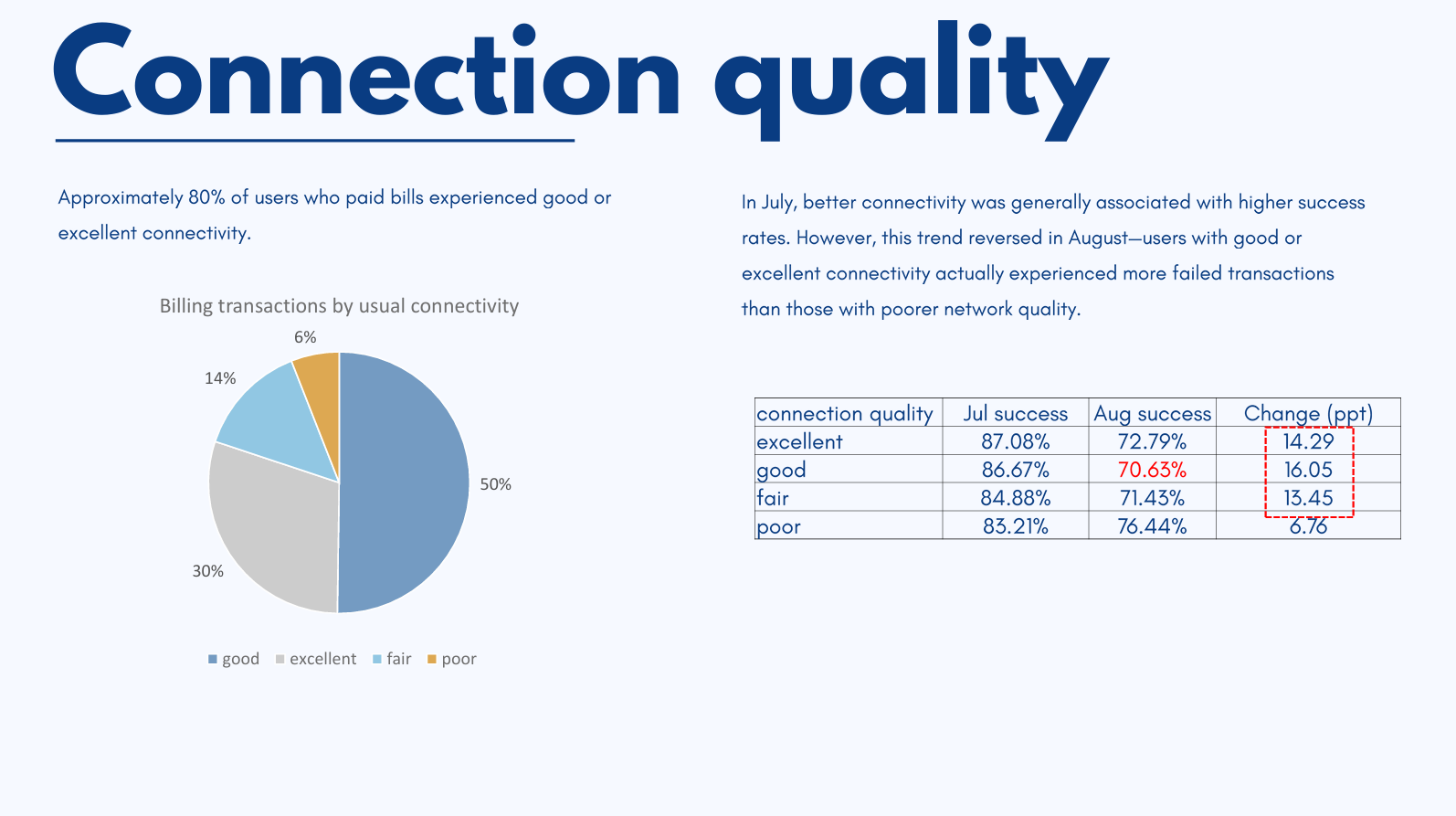

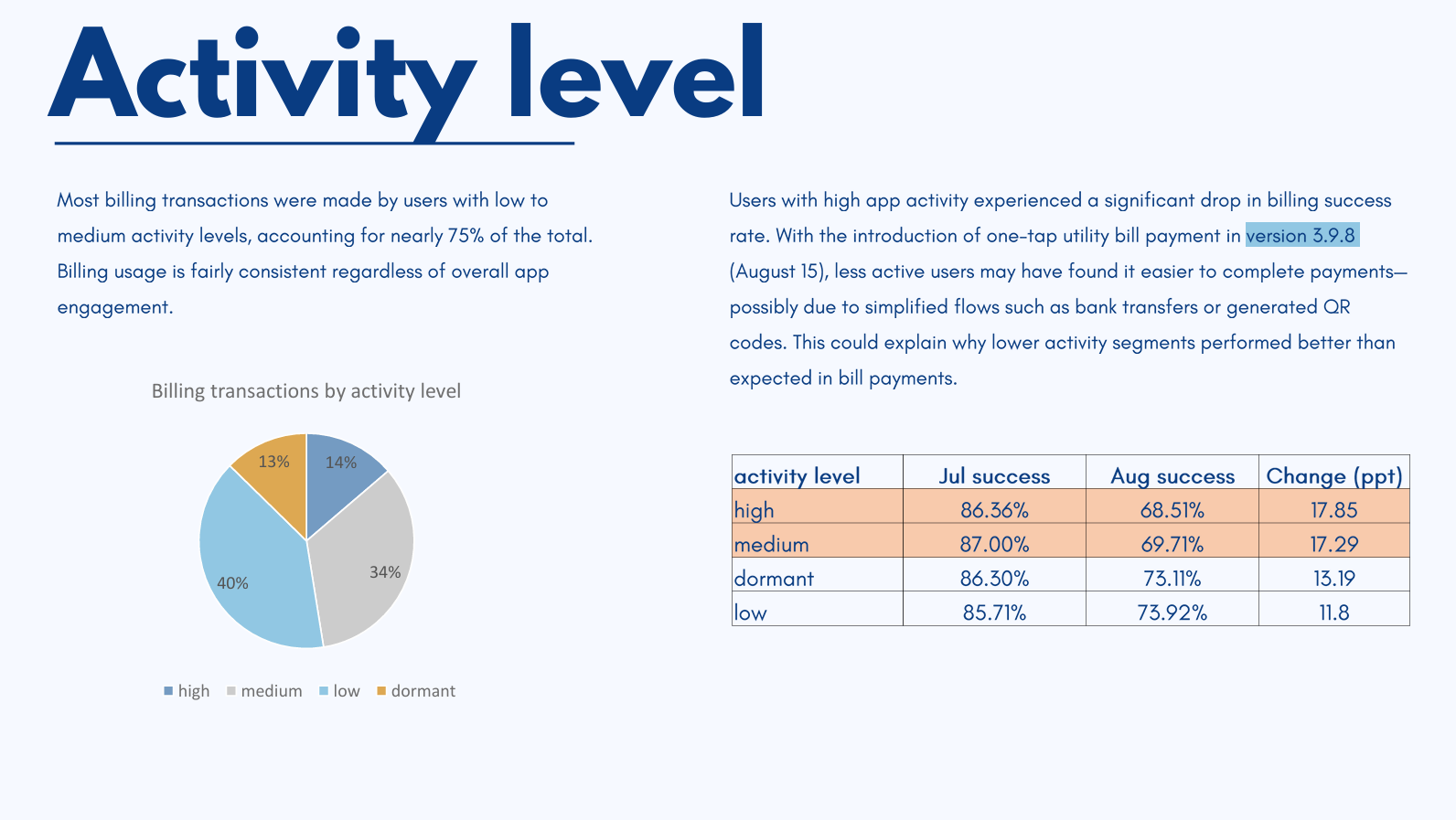

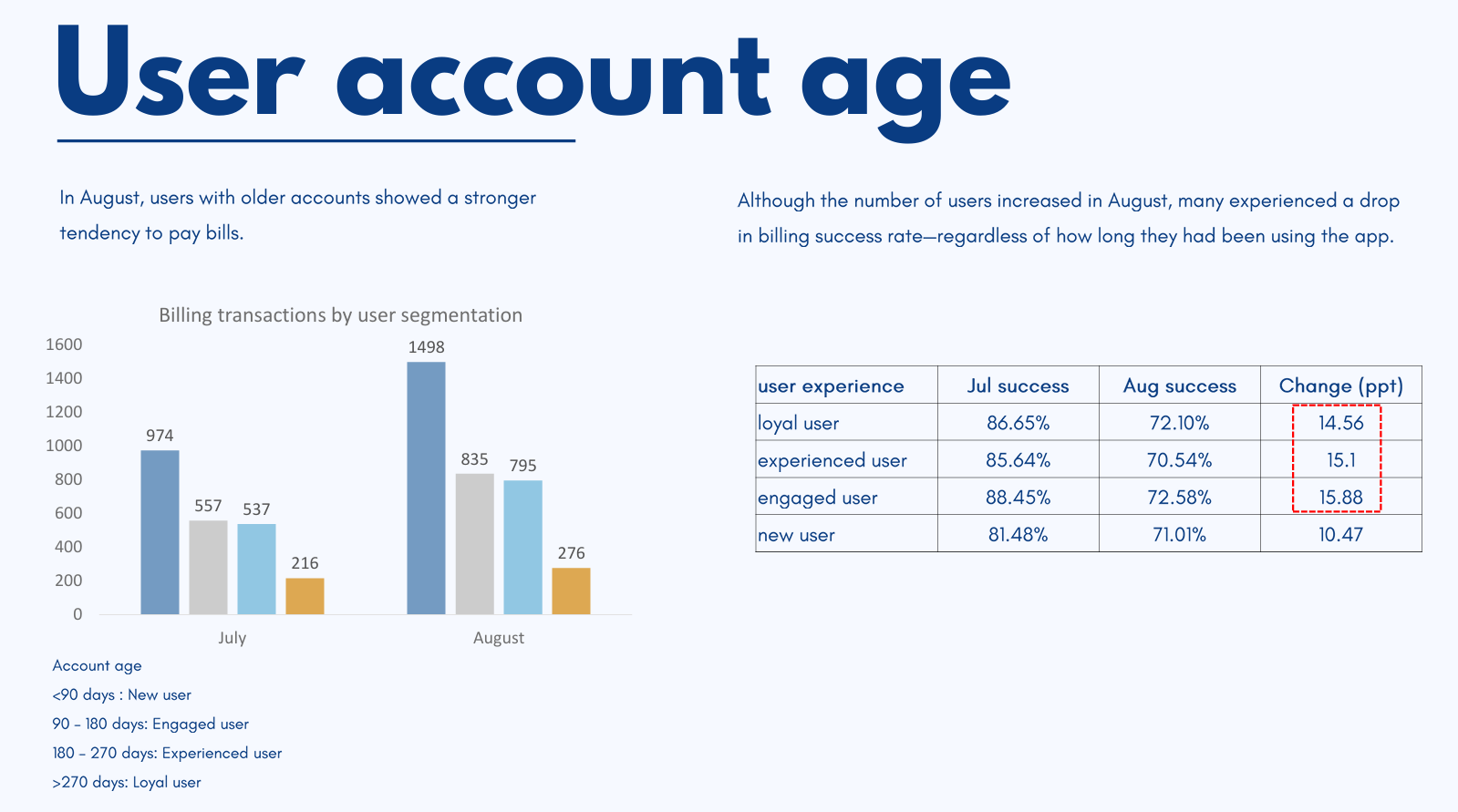

The project analyzes the decline in bill payment success rate on an e-wallet app since August 2025 using transactional, session, event log, and error data. Power BI and the MECE framework were applied to identify failure points across the payment journey, including authentication, gateway redirects, and app version issues. Key insights highlighted correlations between failure rates and user segments, device types, and network quality. The analysis led to actionable recommendations to optimize payment flows and reduce error impact.

Project 2: Credit Risk Analysis

The project focused on analyzing credit risk in a peer-to-peer lending platform using historical loan data from 2007 to 2014. In response to the post-crisis surge in loan applications, using Power BI explores loan records and identifies behavioral patterns that distinguish good loans from bad ones based on credit profile, debt management pattern, financial capability and loan structure. The goal was to provide data-driven insights and recommendations to help reduce default risk and improve lending strategies through better borrower segmentation and risk monitoring.